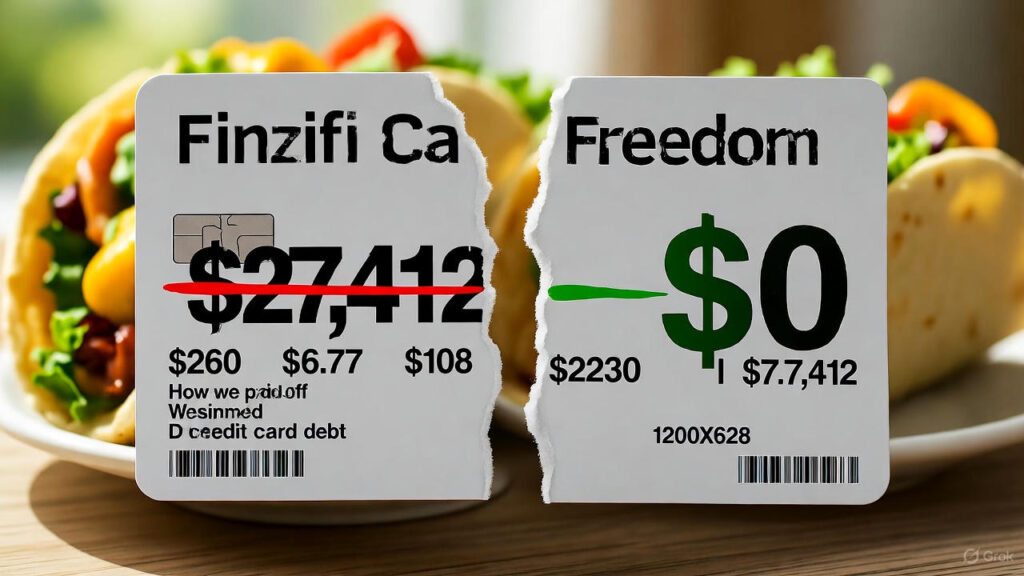

November 3, 2025 – Money Life – I’ll never forget the night I opened my Chase app and saw $27,412.63 staring back at me. My heart raced. My palms sweated. I whispered, “I’m screwed.” But 11 months later? $0.00 balance. $3,800 emergency fund. And yes — I still ate tacos every Friday. This is debt payoff 2025 for real humans who refuse to live on rice and regret. Here’s the step-by-step I used — no fluff, no shame, just results.

1. The Moment I Stopped Lying to Myself (Debt Payoff 2025 Day 1)

I printed my statement. Circled the total in **blood-red ink**. Taped it above my desk. Then I did the math that hurt: Minimum payments = 29 years. Interest = $440/month. That night, I canceled Netflix, skipped takeout, and cried into a $1.99 ramen. But that was the last time ramen was my dinner.

2. The 4 Moves That Killed $27K (No Starvation Required)

- Move 1: Called & Begged → Got APR slashed from 24.9% to 8.9% (saved $1,920/yr)

- Move 2: Turned Trash into Cash → Sold PS5, old iPhone, clothes → $1,100 one-time boost

- Move 3: Weekend Warrior → Drove Uber 10 hrs/week → $640/month extra

- Move 4: Snowball on Steroids → Paid smallest card first → 6 cards gone in 7 months

By month 8? I was throwing $3,200/month at the last card. Paid off **March 14, 2025**.

3. Your 30-Day “Debt Payoff 2025” Kickstart (Start Tonight)

- List every debt (use undebt.it — free)

- Call your card → Say: “I’m facing hardship. Can you lower my rate?” (script in comments)

- Pick one “pain gig” → DoorDash, TaskRabbit, sell one thing on FB Marketplace

- Auto-pay the win → Set $50+ extra to smallest debt every payday

Burn party: I shredded the final statement in my backyard. Best. Feeling. Ever.