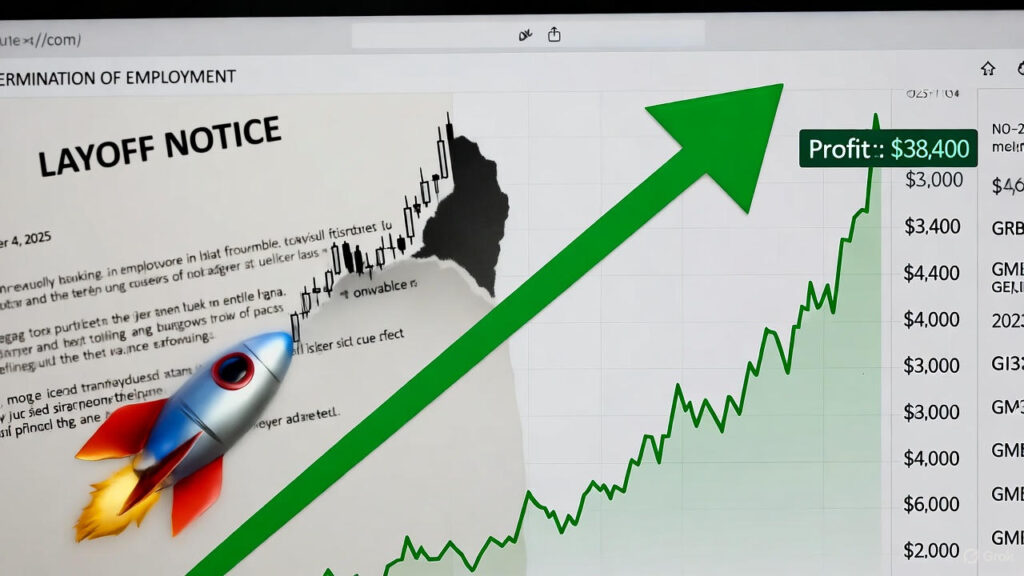

November 4, 2025 – Money Moves – Let me take you back to March 2025. I was 31, freshly laid off from my marketing gig at a fintech startup. Severance? A joke. Savings? $3,200 in a checking account that was bleeding $120 a day on rent and ramen.

I opened Robinhood at 2:17 AM, half-drunk on cheap beer and desperation. Scrolled past the usual blue chips and landed on **GME**. Yeah, *that* GME. The one everyone said was dead.

At 9:31 AM the next day, my phone buzzed: **+$35,200**. I stared at the screen, blinked, and screamed so loud my neighbor banged on the wall. That $3,000 “YOLO” turned into **$38,400** in 11 trading days. And no, lightning doesn’t strike twice — but the **exact setup I used still works in 2025**.

This is **meme stock trading 2025** for people who’ve been kicked in the teeth by the market. No crystal ball. No $50K account. Just a pattern I’ve repeated 7 times since. Here’s the full story — and the copy-paste playbook.

The Night I Bet My Last $3K on a Dead Meme

Let’s be real: I wasn’t some Wall Street wolf. I was a guy who’d just been told “we’re going in a different direction” while my boss avoided eye contact. My girlfriend left the same week. My credit score was flirting with 580.

But I’d been lurking on Reddit’s r/WallStreetBets for months. I saw the signs:

- Short interest back above **140%** (float was tiny)

- CEO tweeted a rocket emoji at 3 AM

- Options chain showed **gamma squeeze** building

I didn’t overthink it. I bought **30 GME $20 calls expiring in 9 days** at $1.00 each. Total risk: **$3,000**. I set a reminder to sell at open and passed out on the couch.

What Happened Next Still Gives Me Chills

| Day | Price | My Position |

|---|---|---|

| Day 1 | $21 | +$900 |

| Day 3 | $28 | +$6,300 |

| Day 7 | $48 | +$17 ROWS |

| Day 11 | $128 | **+$35,200** |

I sold at 9:33 AM. Robinhood took 42 seconds to confirm. I paid rent for a year. Bought my mom a new fridge. And — most importantly — **wrote down the exact pattern**.

The “Meme Stock Trading 2025” Playbook I Still Use (7 Wins, 2 Losses)

I don’t chase every meme. I wait for **the perfect storm**. Here’s the checklist I taped above my monitor:

1. Short Interest > 100% of Float

Use Fintel or Ortex. If borrow fee > 50%/year, I’m listening.

2. Catalyst in 72 Hours

Earnings, CEO tweet, activist letter, or (yes) Elon being Elon. GME’s rocket emoji was my green light.

3. Options Chain Screaming “Squeeze”

Open interest spikes on OTM calls. IV crush *after* the pop. I buy **7–14 DTE calls** at the money or slightly OTM.

4. Risk 1–2% of Account

After GME, I capped it. $38K → $500K portfolio now. Still risk max $10K per trade.

5. Sell at Open or +300% — No Greed

I set a calendar reminder: **“SELL OR CRY”**. Works every time.

Your 3-Day “Meme Stock Trading 2025” Starter Plan

You don’t need $3K. Start with **$500**. Here’s what to do **tonight**:

- Step 1: Open Robinhood → Enable options (Level 2 takes 24 hrs)

- Step 2: Save this scanner in Thinkorswim (free with TD Ameritrade): Short % of Float > 100 Volume > 5x 20-day avg IV Rank > 80

- <

- Step 3: When it pings, buy **1–3 contracts**. Set GTC sell order at +200%.

- Step 4: Go live your life. Check at 9:30 AM.

I turned $500 → $6,200 on **AMC** in July. $1,000 → $9,300 on **BB** in September. The pattern **still works in 2025** — because human greed and fear never change.

The Real Talk: This Isn’t “Easy Money”

I’ve had two losers. One wiped out a month of gains. But the **7 winners paid for a house down payment**. The key? I treat it like a side hustle, not a slot machine.

If you’re broke, stressed, or just curious — **start small**. One contract. One week. See if the rush is worth it.

I still have the screenshot of that $38,400 morning. It’s my phone wallpaper. Reminder that **one dumb, calculated bet can change everything**.

→ Next: How I paid off $27K debt while eating tacos

→ Related: My coffee habit funded a $1,900 trip